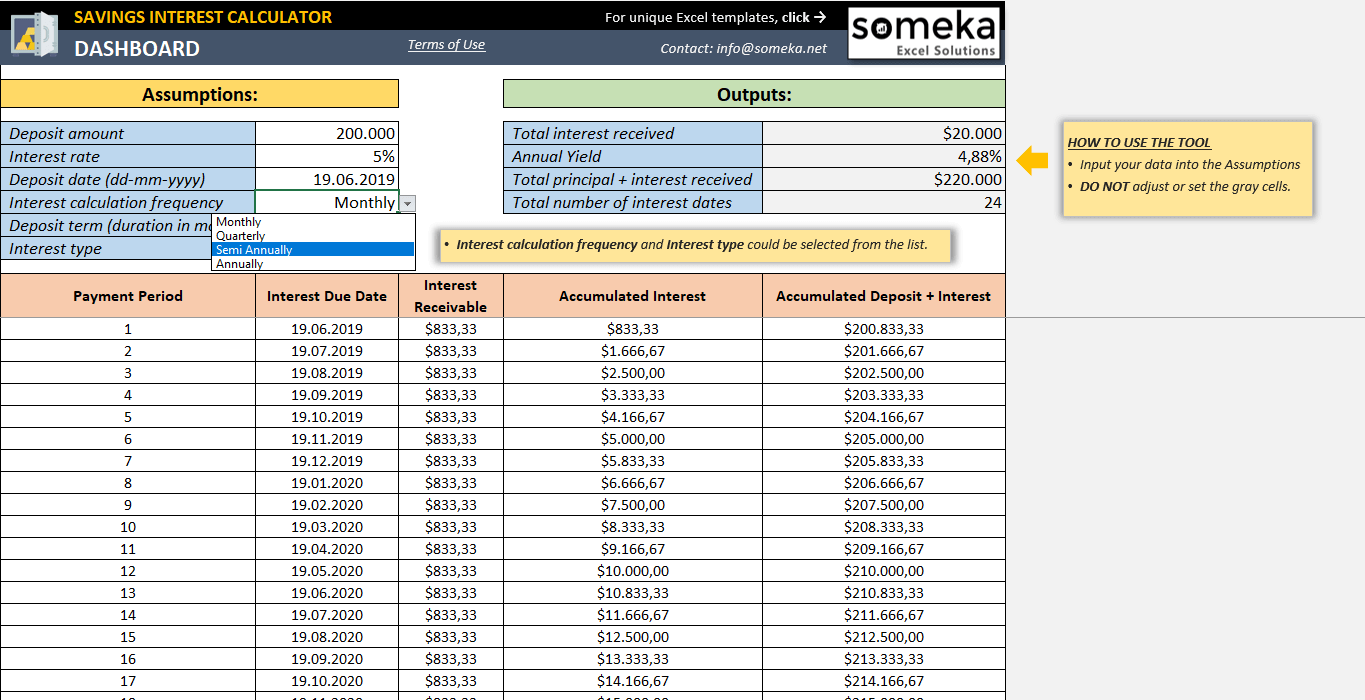

What is a savings calculator? How do you calculate interest on savings account? Using our savings interest calculator will give you an idea of what interest you will receive after tax each month or year and help you make the most of your money. Simply key in the amount of savings you have, your current interest rate and choose the tax status of your account and we’ll calculate how much interest you’ll earn on that amount.

Please note this calculator assumes the interest rate doesn’t change, no further deposits or withdrawals are made and that interest is paid. Use our savings calculator to see how much interest you can earn from your savings account No matter how much or how little, saving is a great habit to get in to. This calculator works out how much a regular monthly savings scheme could make and how much a lump sum investment could be worth over time.

How to calculate your savings growth. Our simple savings calculator helps you project the growth and future value of your money over time. If you want to know the compound interval for your savings account or investment, you should be able to find out by speaking to your financial institution.

By doing this, you are figuring out how much interest your balance is. Calculate again by adding a regular monthly deposit to see how a recurring deposit makes a difference in your total.

Enter a different number of. Calculate interest amounts over time to help you make better financial decisions. See how your regular savings will grow and how compound interest accumulates.

Any calls like this are not from Moneyfacts. Before you decide on a savings account, you’ll want to know how much you can earn from it. This lump sum savings calculator will help you to precisely calculate the amount of interest you’ll receive by contributing a lump sum of money to your savings account, helping you see if your preferred account is right for you. This tool gives you an indication of how long it will take to reach your goal.

This calculator considers many different factors such as tax, inflation, and various periodic contributions in order to estimate the end balance of savings. Savings Calculator.

Regarding savings accounts in particular, the annual percentage yield (APY) given by banks is the interest rate compounded and expressed as an annual figure. Our monthly savings calculator shows how much your savings will be worth with interest over time.

If you have a savings goal, our calculator shows you how long you will need to save to reach it. Just enter how much you plan to save each month, for how long and the interest rate of your savings account or ISA to see what this will be worth in the future, assuming interest is compounded monthly. The interest calculator helps illustrate how much money will be made with the power of compound interest.

Using the compound interest formula, you can determine how your money might grow with regular deposits or withdrawals. Using a savings calculator allows you to see how fast your money will grow when put in an interest -earning account. It can help you compare and contrast your potential savings for different scenarios. Business Term Deposit.

High fixed interest rate for business savings. A savings account is basically just a place to put cash in to earn interest and save for the future. You choose the timeframe.

Some accounts are variable rates with easy access while others are fixed where access to your money is restricted. We also look at the halfway-house of notice account. This is your starting rate for savings. Your savings account may vary on this, so you may wish to check with your bank or.

Calculate your savings return. Compounding of interest. Work out how much interest you will earn. An affordable way to grow your wealth.

Regular investing offers a popular and affordable way of building an investment portfolio. It’s easy to set up a direct debit from just £a month. If your account is untaxed then enter zero as the marginal tax rate in the above calculator.

Then try it again with $or $1per month to see how regularly adding even a small amount can move you closer to your. When HMRC calculates the tax you owe, they’ll first look at your income from other sources, and then from your savings income.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.