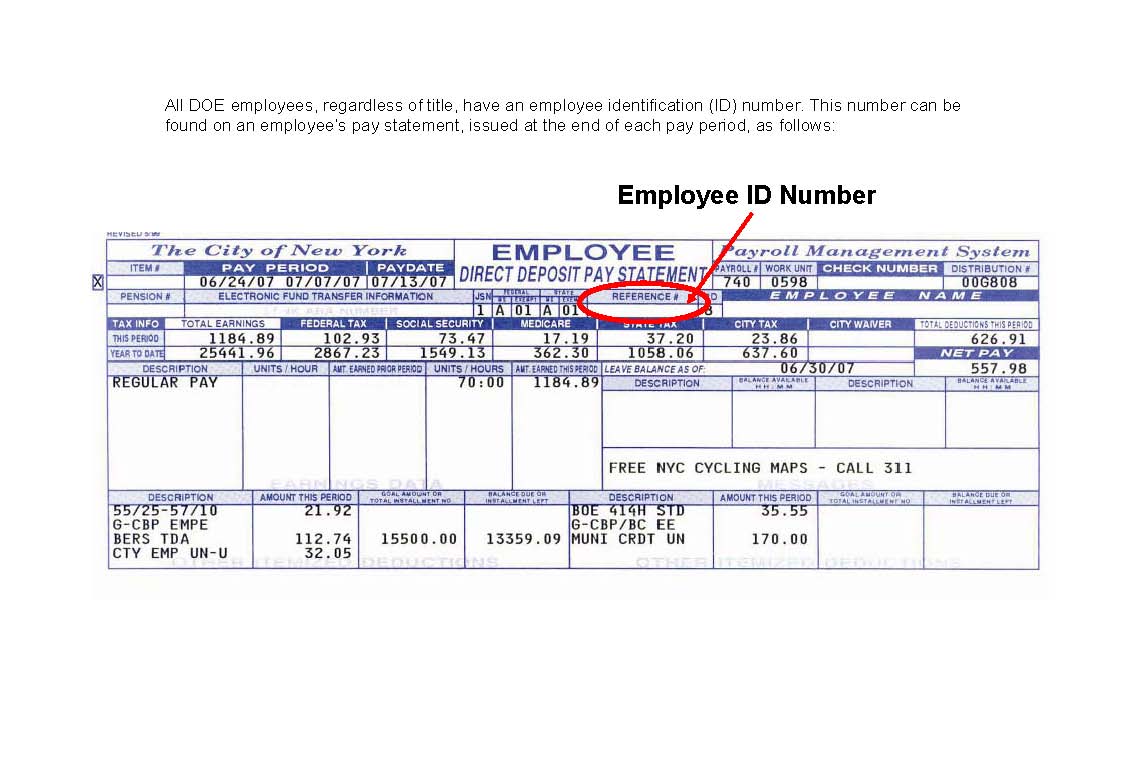

What is a coded payroll number? How do I find out what my payroll number is? The payroll number is a set of numbers assigned to an employee as a reference for salary reports.

Wages are calculated and assigned to the employee according to his or her number, which is also called an employee number or staff ID. A payroll number is usually three to eight digits long, depending on the number of employees in the department.

Your payroll number will usually be found on your payslip. Understanding your payslip. Your payslip can include a range of information which could vary from company to company, but there are five things it must always display.

Some companies use payroll numbers to identify individuals on the payroll. The date your pay should be credited to your bank account is usually shown.

The number here represents the tax period for that payslip, for example, if you’re paid monthly, = April and = March. Payroll number may or may not be on payslip, Depends on what format employer uses. It is possible the 1will be payroll number, check with payroll.

Income tax week is from. Private medical cover? Otherwise check with payroll on Monday. Sage line is the wrong programme, that is for accounts not payroll. You need Sage Payroll. Talk to their customer services line and ask all the. All your personal data organisation data, benefits, time data, payroll data etc are linked to the payroll number. Your Key ID will always stay the same, even if you leave Key Portfolio and then rejoin.

Mind that not every employer that has employees needs to deal with PAYE — although every employer must keep the payroll records in order. Assignment Number Uses the first digits of your Employee number.

If you have more than one post these will be indicated by the addition of --etc. Browse: Payroll A to Z. The best place to find this information is on your payslip.

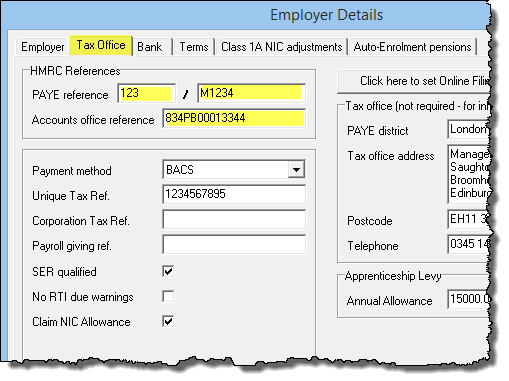

Employer reference number can be used in many ways. An employer reference number is a unique combination of letters and numbers, also called an employer PAYE reference, PAYE reference number or just abbreviated to ERN.

It is given to a business when it registers with HMRC as an employer, serving to identify the employer for employee income tax and national insurance purposes. Does anyone know what the number is for payroll ? A payroll program account is an account number assigned to either an employer, a trustee or a payer of other amounts related to employment to identify themselves when dealing with the Canada Revenue Agency.

This 15-character payroll program account number contains the nine-digit business number (BN). Nonfarm payrolls is the measure of the number of workers in the U. Sage 50cloud Payroll automatically generates the BACS hash using the following: A recognised algorithm based on the company bank sort code. This is measured by the Bureau of Labor. Tax Period: This represents the tax period for that specific payslip.

Remember that the tax year is April to March. Employee moving to a new payroll under a different employer reference Transfer the payroll records to the new employer reference. With a single submission at year en HMRC could simply count how many P14s you submitted for that person.

After the payroll is adjusted for the different components, the final total that the employee takes home is known as the net pay, or net amount, of the check. Net pay is the amount that the employee gets to keep for themselves and spend however they see fit.

SCON stands for Scheme Contracted-out Number. They are optional character reference numbers. Depending on the type of contracted-out pension, you may also have an SCON for each member of the scheme. Real Time Information (RTI) is the most significant change ever made to PAYE.

An improved way of reporting, RTI is designed to make PAYE submissions more efficient – meaning you’ll need to submit information to HMRC in real time, every time you pay employees. Payroll software is a good middle of the road option, affordable for most companies and simple to use so it saves some labor time. A payroll company may also be able to help answer any questions that you have.

An employment contract is an agreement between an employee and employer which will stipulate various conditions including pay, responsibilities and hours of employment during a specific period.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.