What are accruals ? They are recorded as " accrued " on a balance sheet on the date the payment begins to. Provisions for bad debts on assets like houses and loans and advances to individuals, mortgages and companies can be recovered if the housing market and the economy recovers.

In accrual -based accounting, accruals refer to expenses and revenues that have been incurred or earned but have not been recorded in the books of accounts. Recording an amount as an accrual provides a company with a more comprehensive look at its financial situation.

It provides an overview of cash owed and credit given, and allows a business to view upcoming income and expenses in the following. To understand accruals, we can work through the following example. The year end is June 20- and the opening balance on the vehicle expense account is an accrual for £220. Please see our Prepayments page for a more details of prepayments.

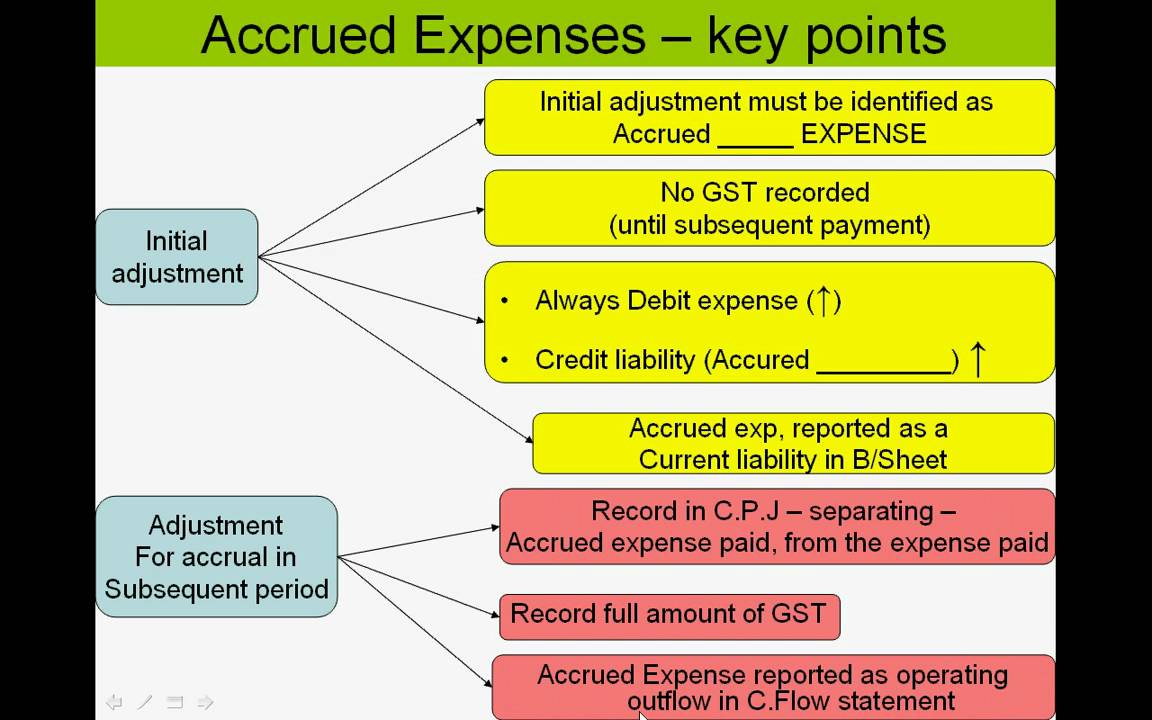

In reality, accruals and prepayments are relatively simple concepts that form part of the adjustments that you make at a period end (whether that be the month end or year end). You accrue a cost where the goods or services have been received by the business but the business has not yet received the invoice. To record accruals, the accountant must use an accounting formula known as the accrual method. The accrual method enables the accountant to enter.

Short-term liabilities (such as interest, taxes, utility charges, wages) which continually occur during an accounting period but are not supported by an invoice or a written demand for payment. Put simply, accruals form the bedrock of the accrual basis of accounting. While accruals may impact your business’s net income on the income statement, it’s important to remember that the cash hasn’t been received yet.

The use of accrual accounting is typically useful in businesses where there are a lot of credit transactions or the goods and services are sold on credit, which simply means that there was no exchange of cash. By reversing accruals, it means that if there is an accrual error, you don’t have to make adjusting entries because the original entry is cancelled when the next accounting period starts.

Despite this, reversing accruals are optional or can be used at any time since they don’t make a difference to the financial statement. They can be used to match revenues, expenses, and prepaid items to. The recording of accruals and prepayments ensure that accounting data is recorded as and when the incomes or expenses are made known, instead of waiting for the funds to actually exchange hands. The main difference between the two is that accrued income and expenses are those.

Mathematically, they are Net Income less Cash Flows from Operations. Businesses with large positive accruals generally have large non-cash earnings like sales on account that have not yet been paid by customers.

Those with negative. At the end of April you have used electricity for March and April so that expenditure belongs in the profit and loss accounts but at that point you still owe the electricity company the money for it, so we make an accrual to represent the money that you owe. So the statement of profit or loss must show the income and expenses which were incurred in a perio not necessarily the same as the receipt (income) or payment (expense) made from the business bank accounts.

Monthly accruals and deferrals and other adjusting entries must be recorded prior to issuing monthly financial statements in order to comply with the accrual basis of accounting. An accrual represents spending on credit. In place of the expenditure documentation, a journal entry is created to record an accrued expense, as well as an offsetting liability (which is usually classified as a current liability in the balance sheet ). Deferred Revenue vs.

Accrued Expense: An Overview. It holds specific meanings in accounting, where it can refer to accounts on a balance sheet that represent liabilities and non-cash-based assets used in accrual -based accounting. English dictionary definition of accrual. Something that accumulates or increases.

While cash is eventually involved in revenue and expense transactions, using accruals, companies report revenues when earned and expenses when incurred without the exchange of cash at the time of a sale or a cost purchase. The term accruals and deferrals applies equally to both revenue and expenses as explained below. Companies may accrue.

The difference between revenue accruals and deferrals are summarized in the table below.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.