Hourly rates, weekly pay and bonuses are also catered for. Why not find your dream salary, too? Enter your hourly wage and hours worked per week to see your.

If you do not pay National Insurance, for example, if you. I do not pay National Insurance I am eligible for the Blind.

Net Wage Calculator: Wage is normally used to describe your monthly gross income. Your net wage is found by deducting all the necessary taxes from the gross salary. To determine net pay, gross pay is computed based on how an employee is classified by the organization.

At 20% standard tax that will be £6tax thank you. Well done on the bonus. How do you calculate net pay? What is net pay and total cost?

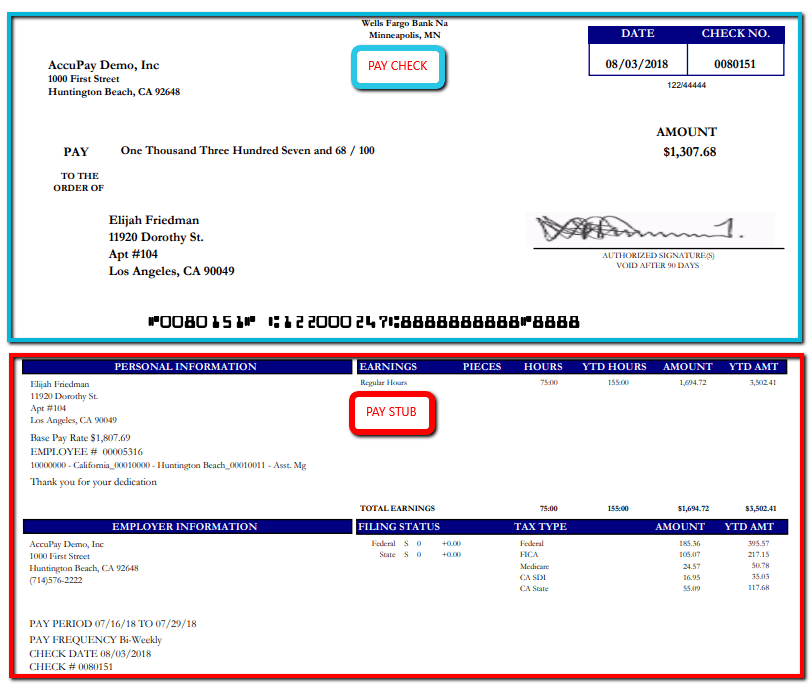

Net to Gross Salary Calculator At Stafftax we strongly advocate discussing and agreeing salaries in gross terms. Enter the net wage per week or per month and you will see the gross wage per week, per month and per annum appear. A payslip is a summary of your earnings and deductions issued by your employer on a weekly, bi-weekly, or monthly basis – depending on how often you get paid.

For an estimate of your take-home pay, please fill in your salary below. Student Loan Deduction? To find out your take home pay, enter your gross wage into the calculator. By default, the calculator selects the current tax year, but you can change this to a previous tax year if desired.

If you are not calculating a real payroll, but want some rough figures, this calculator shows you the effect of PAYE, NIC and student loan deductions. Your final salary is calculated by deducting income tax and national insurance from your gross salary. Income tax and NI rates are set in bands and subject to change each year by HMRC, with everyone entitled to a tax free allowance on their earnings.

Your net pay is what you actually receive into your bank account once all the deductions have been taken off. Most employers will pay your earnings directly into your bank account. Your monthly net pay will be £845.

Most individuals pay Income Tax through the pay -as-you-earn (PAYE) system. If your pay varies or you’re not paid weekly, you have to use a 12-week period for working it out. The 12-week period. You can work out your weekly pay by getting an average figure for a 12-week.

Definition: Net pay, also referred to as take home pay, equals an employee’s total pay less all deductions. In other words, net pay is the amount of money on each employee paycheck.

Net pay is the amount of wages that employees actually take home. For example tax and National Insurance, and what the deductions are for. Since it is the most common NI class, our calculator makes deductions for Class NI. It is a reflection of the amount your employer pays you based on your agreed upon salary or hourly wage.

For example, if your employer agreed to pay you $15. Using our last example, if you earned $450. This is called your net pay. Simply enter your gross annual salary - which is the amount you get before Income Tax and National Insurance - and how much you pay into your pension scheme, annually.

Net price is $4 gross price is $50and the tax is 25%. You perform a job and your gross pay is $50. If your work involves travel between different assignments, and your employer doesn’t pay you for that time, you might not be getting all that you’re owed.

Additionally, if your work does not cover the cost of travelling between different assignments, then you could be underpaid and not receiving what you are legally owed.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.