What does Apr stand for in interest? APR, although you should always check the terms and conditions. Importantly, it includes the standard fees and interest you’ll have to pay.

Let’s say you borrow £10over years to buy a car. In this two-minute video, Which? Mine currently offers 6. At the repayment rate you state, you would repay only £10 or £1in interest. So there are presumably some high loan fees that you must repay in addition to the £per.

It was introduced by the government to protect members to the public who apply for loans. Lenders are very crafty and crooked and what they were doing is to disguise the true cost of a loan. Where credit cards or loans use a representative APR, this means 51% of successful applicants will be given the stated interest rate. If a loan is advertised as being 7. The other 49% could get a different rate (which is usually higher).

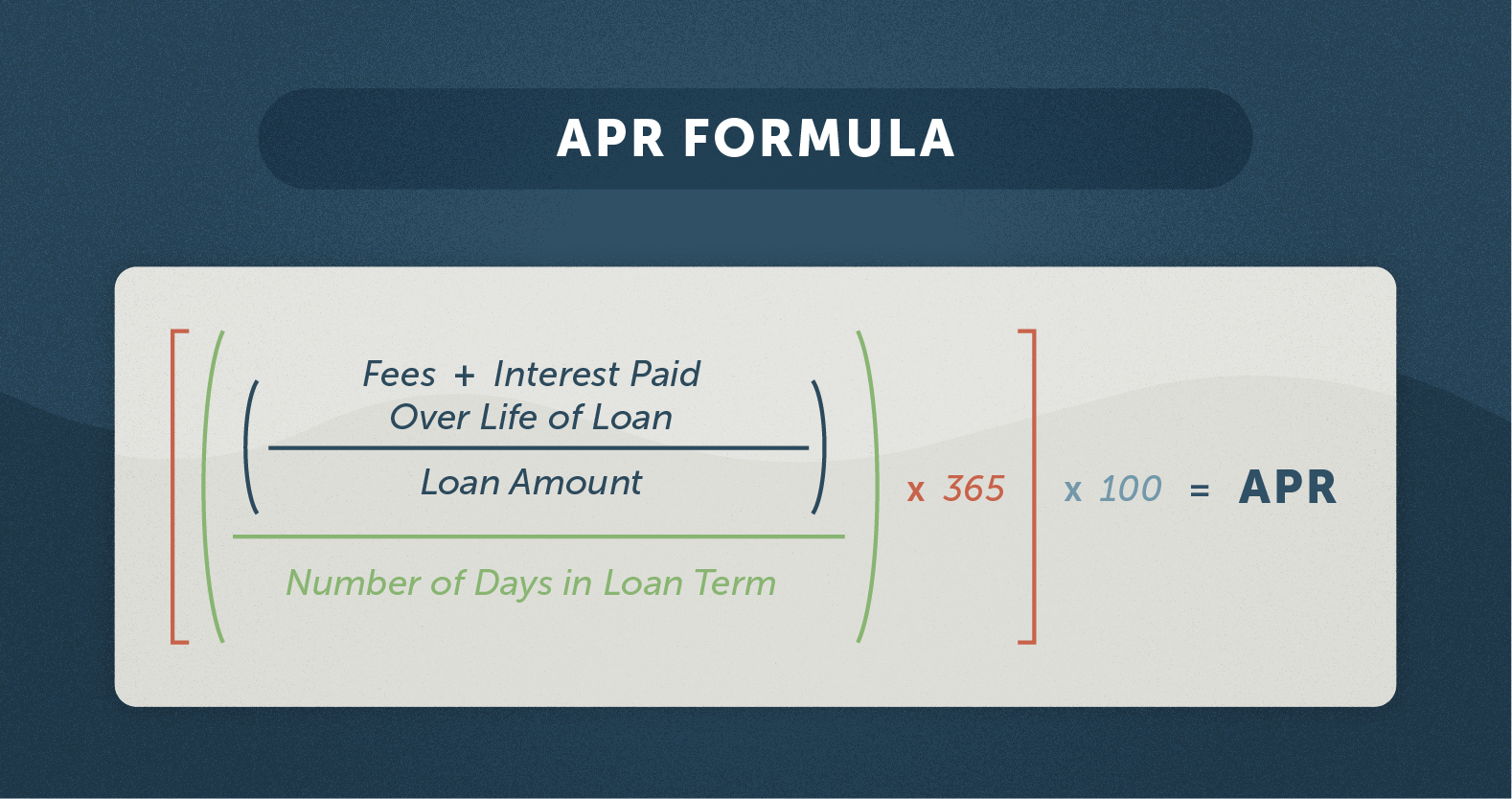

In other words, it describes how much interest you’ll pay if you borrow for one full year. It represents the cost of taking out a loan, credit card or mortgage. It includes the cost of the interest rate as well as any fees that are automatically added to the loan, for example, arrangement fees. The interest rate is just that - the interest on the loan.

APR is an annualized rate. This means that it is the rate of interest you would pay on a loan over a year, if you would borrow the loan for a full year. Extra costs associated with loans.

What happens if you miss a loan payment? It factors in the interest, as well as all the other costs of your loan. It is worked out over the course of the year as opposed to each month. The calculation includes any fees you may need to pay, plus the interest rate a lender applies to your particular loan.

Many loans last longer than one year. It takes into account interest, as well as other charges you may have to pay such as an annual fee.

An annual percentage rate (APR) is the interest rate you pay each year on a loan, credit car or other line of credit. It’s represented as a percentage of the total balance you have to pay. Whenever you borrow money, any interest you pay increases the cost of the things you buy with that money. It is a finance charge expressed as an annual rate.

In simple terms, how much extra you have to pay back on loans and purchases. It shows it by displaying the amount that you will need to repay in interest on an annual basis.

With just few numbers, including the loan amount, term of the loan and APY, you can calculate what you pay in interest on a monthly or yearly basis. It can give an indication of exactly how much your mortgage, vehicle loan or fixed rate loan is costing you. That can account for why your personal loan interest rate may be higher than the rate for your mortgage or auto loan.

This is important when it comes to loans, as an attractive percentage on a short amount of time may be a worse deal over a longer period of time. It shows the full cost you would pay on credit if you took it out for a year (including fees and interest). When you receive an interest rate quote from your lender, it may be expressed in interest rate per term.

Representative Example: The table shows the monthly repayment and total cost of a £10loan at a fixed rate of 3. Lending Code, which sets the minimum standards for the way banks, building societies and other providers should treat their customers.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.