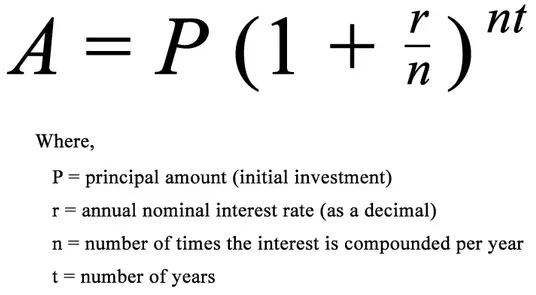

So, fill in all of the variables except for the that you want to solve. This calc will solve for A (final amount), P (principal), r ( interest rate ) or T (how many years to compound ). Calculate compound interest on an investment or savings. Using the compound interest formula, calculate principal plus interest or principal or rate or time.

Includes compound interest formulas to find principal, interest rates or final investment value including continuous compounding A = Pe^rt. What is a continuous compounding calculator? When to use continuous compound interest? How do you calculate principal and compound interest?

The following calculator allows you to quickly determine the answer to these sorts of questions. To calculate your forecasted earnings on an investment, enter your initial investment, the amount you plan to add periodically, the anticipated interest rate, the compounding interval, and how long you anticipate holding the investment. Regular Monthly Action. Continuous compound interest calculator.

Use the calculator below to calculate the future value, present value, the annual interest rate, or the number of years that the money is invested. Please use our Interest Calculator to do actual calculations on compound interest.

User enters dates or number of days. Currency £ Annual Interest Rate % Interest Action.

The value in continuous compounding interest is really conveyed when looking at how an investment grows over time. I greet you this day, First: read the notes. Second: view the videos.

Fourth: check your solutions with my thoroughly-explained solutions. Fifth: check your answers with my calculators. I wrote the codes for these calculators using JavaScript, a client-side. Principal is the initial amount invested.

This website uses cookies to ensure you get the best experience. By using this website, you agree to our Cookie Policy. Multiply the principal amount by one plus the annual interest rate to the power of the number of compound periods to get a combined figure for principal and compound interest.

Subtract the principal if you want just the compound interest. See How Finance Works for the compound interest formula, (or the advanced formula with annual additions), as well as a calculator for periodic and continuous compounding. Also compare simple interest. Following is the formula for calculating compound interest when time period is specified in years and interest rate in % per annum.

Using a compound interest calculator can give you a unique insight into how a future balance can grow exponentially if you allow for a lengthy compounding period. Compound Interest Formula. Example: Suppose you give $ 1to a bank which pays you 10% compound interest at the end of every year. To use our calculator, simply: Select the currency from the drop-down list (this step is optional).

Below is an example, where Rs 50invested for years at the rate of 12%. A is the initial amount (present value). The formula for calculating compound interest is time agnostic, meaning that we can use the formula for compounding over any length time interval, but we must make sure that the rate represents how much our principal is compounding each perio i. Quickly calculate the future value of your investments with our compound interest calculator.

All data is tabled and graphed in an easy to understand format. Consider the following example: An investor invests $0in a 5-year term deposit with an interest rate of 8% with the interest compounded annually.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.