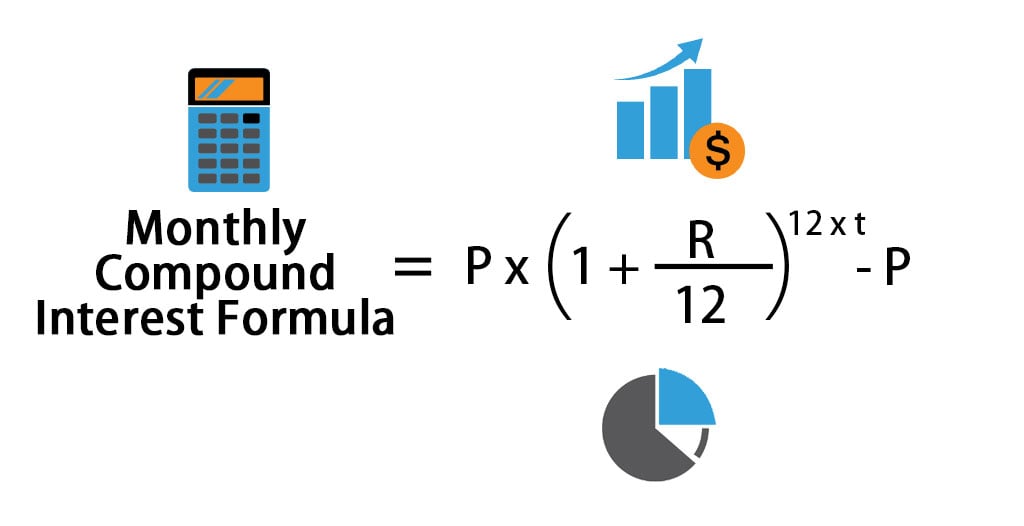

What is the formula for compounded monthly? Start Your Free Investment Banking Course. P = Principal Amount.

Monthly compound interest refers to the compounding of interest on a monthly basis, which implies that the compounding interest is charged both on the principal as well as the accumulated interest. Monthly compounding is calculated by principal amount multiplied by one plus rate of interest divided by a number of periods whole raise to the power of the number of periods and that whole is subtracted from the principal amount which gives the interest amount.

Compound interest is an interest of interest to the principal sum of a loan or deposit. The concept of compound interest is the interest adding back to the principal sum so that interest is earned during the next compounding period. If someone saved P in the bank with x% interest rate and monthly compound. In loan calculation, the principles get paid off month after month.

The more principles is paid off, the less interest in the monthly payment. To calculate compound interest in Excel, you can use the FV function. To use the above compound interest formula, you will need a few variables define mainly the princial amount, annual interest rate, number of years, and the compound periods. For example, to find out how much would $10grow in years with an annual interest rate of 5% and compound monthly, we will plugin the variables to the compound interest formula.

Multiply the principal amount by one plus the annual interest rate to the power of the number of compound periods to get a combined figure for principal and compound interest. Subtract the principal if you want just the compound interest. Read more about the formula. Formula for Monthly Compounding.

This below monthly compounding formula is one of the few formulas used in this calculator to find the total compound interest payable based on the monthly compounded period. Elements of Compound Interest. It is a sum of money which is borrowed or lended or invested.

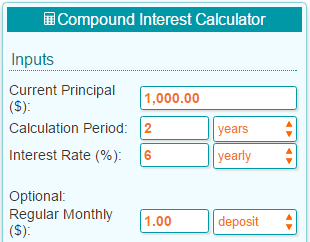

X makes an initial investment of $ 10for a period of years. Find the value of the investment after the five years if the investment earns the return of % compounded monthly. Using the same information above, enter "Principal. For the calculator on this page, not only is principle and interest accumulating interest, but monthly contributions are also accumulating interest.

Below is the compound interest formula on how to calculate compound interest. For calculating yearly compound interest, you just have to add interest of the one.

Calculating quarterly compound interest is just like calculating yearly compound. The compound interest formula is an equation that lets you estimate how much you will earn with your savings account. Calculate compound interest on an investment or savings.

Includes compound interest formulas to find principal, interest rates or final investment value including continuous compounding A = Pe^rt. Simple Interest vs. After using this formula, the simple interest earned would be $120.

Using compound interest, the amount earned would be $126. Assume you put $10into a bank. How much will your investment be worth after years at an annual interest rate of 4% compounded quarterly?

A debt may compound interest annually, monthly, or even daily. The more frequently your debt compounds, the faster you will accumulate interest. You can look at compound interest from the investor or the debtor’s point of view.

Frequent compounding means that the investor’s interest earnings will increase at a faster rate. STEP 2: The annual interest rate is in cell Band the interest is compounded monthly so the interest will be divided by the compounding frequency (in cell B6).

STEP 3: Since compounding is done monthly, we need to multiple the no of years (cell B6) with compounding frequency (cell B5).

No comments:

Post a Comment

Note: only a member of this blog may post a comment.