Initial Purchase Amount. Multiply the principal amount by one plus the annual interest rate to the power of the number of compound periods to get a combined figure for principal and compound interest. Subtract the principal if you want just the compound interest.

Daily Interest Rate in Percentage. This compound interest calculator has more features than most. You can vary both the deposit intervals and the compounding intervals from daily to annually (and everything in between).

Show Full Instructions This flexibility allows you to calculate and compare the expected interest earnings on. What is a daily loan calculator? How do you calculate compounding interval?

This is a free online tool by EverydayCalculation. The daily compound interest calculator can be used to. It is the interest calculated on initial principal plus all the accumulated interest from previous periods on a deposit. In different words it is “ interest on interest ”. Interest can be compounded on any given frequency schedule, continuing from daily to annually.

The concept is such that it assumes that the interest earned every day is reinvested at the same rate and will get increased as the time passes. Thank you for your amazing calculator. I was using the simple interest calculator for my business for about a year and now I am using the compound interest one.

I noticed that the APY for daily compounded is lower than the APY for monthly compounded interest. You can either calculate daily interest for a single loan perio or create a loan schedule made up of multiple periods, each with their own time-frames, principal adjustments, and interest rates.

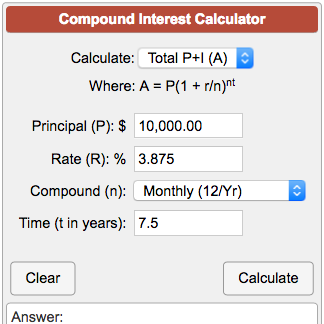

A compounding interest calculator is the fastest way to understand exactly how much interest you’ll accumulate by continuing to reinvest earnings into the same account. Try making adjustments to the compound interest calculator to see how much more you might. How does the compound returns calculator work?

Because financial institutions have different compounding rate frequencies - daily, monthly, yearly – we’ve given you the option to choose your own. Your total returns depend on your return rate period and timeframe, so again we’ve given you the option to change those fields.

Home mortgage loans, home. Most years have 3days, while leap years have 3days. This means there is a bit more than weeks in the average year, with there being weeks and day in most years while there is weeks and days on leap years.

The above calculator compounds interest daily after each deposit is made. If you want to make deposits at the end of each day, then please subtract the first deposit from the initial savings amount. Deposits are applied at the beginning of each day.

Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. For example, $10at 8% annual interest rate, compounded annually for years.

The interest can be compounded annually, semiannually, quarterly, monthly, or daily. Include additions (contributions) to the initial deposit or investment for a more detailed calculation. See how much you can save in1 1 etc. The following three examples show how the FV function is related to the basic compound interest formula.

The compound interest calculator below can help you visualize the difference and explore alternatives for your savings. You can calculate based on daily, monthly, or yearly compounding. How to Calculate Compound Interest in Excel.

Check out the wonders of compound interest with the calculator below. It is made particularly useful with the top up box, to simulate regular savings over a period of time. By entering a negative start amount, it can show you the effect of paying regular amounts off debts such as loans.

When interest is calculated daily, it means the interest that accrues on the account is added to the account each day. This additional interest starts accruing more interest the next day. To take this into account, you need to use the compound interest formula to accurately predict how much interest will accrue on your account. You need to know the annual rate, how many days the money remains.

T number of days between the date your last payment is received and the date your current payment is received is counted in this method. Included are options for tax, compounding perio and inflation.

Simple interest calculator You can use the calculator below to calculate interest payments. The Hardwicke online calculators are provided for you to use free of charge, and on an “AS IS” basis, without any technical support or warranty of any kind from Hardwicke including, without limitation, a warranty of merchantability, fitness for a particular purpose and non-infringement.

Understanding the base formula of compound interest is the key in knowing how to compute for the daily, monthly, quarterly, or semi-annual compound interest easily. If you’re having a hard time, download the exercise file in Chapter of this tutorial and try to understand how the formula works.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.