The needs of company car drivers are many and varied – and. Next, we need to work out which band the car falls into. Bauer Media Group consists of: Bauer Consumer Media Lt.

Car Tax in the UK Last year was an important time for car. Parkers guide to company cars : news and advice to help you. All registered in England and Wales. What is Parkers car tax?

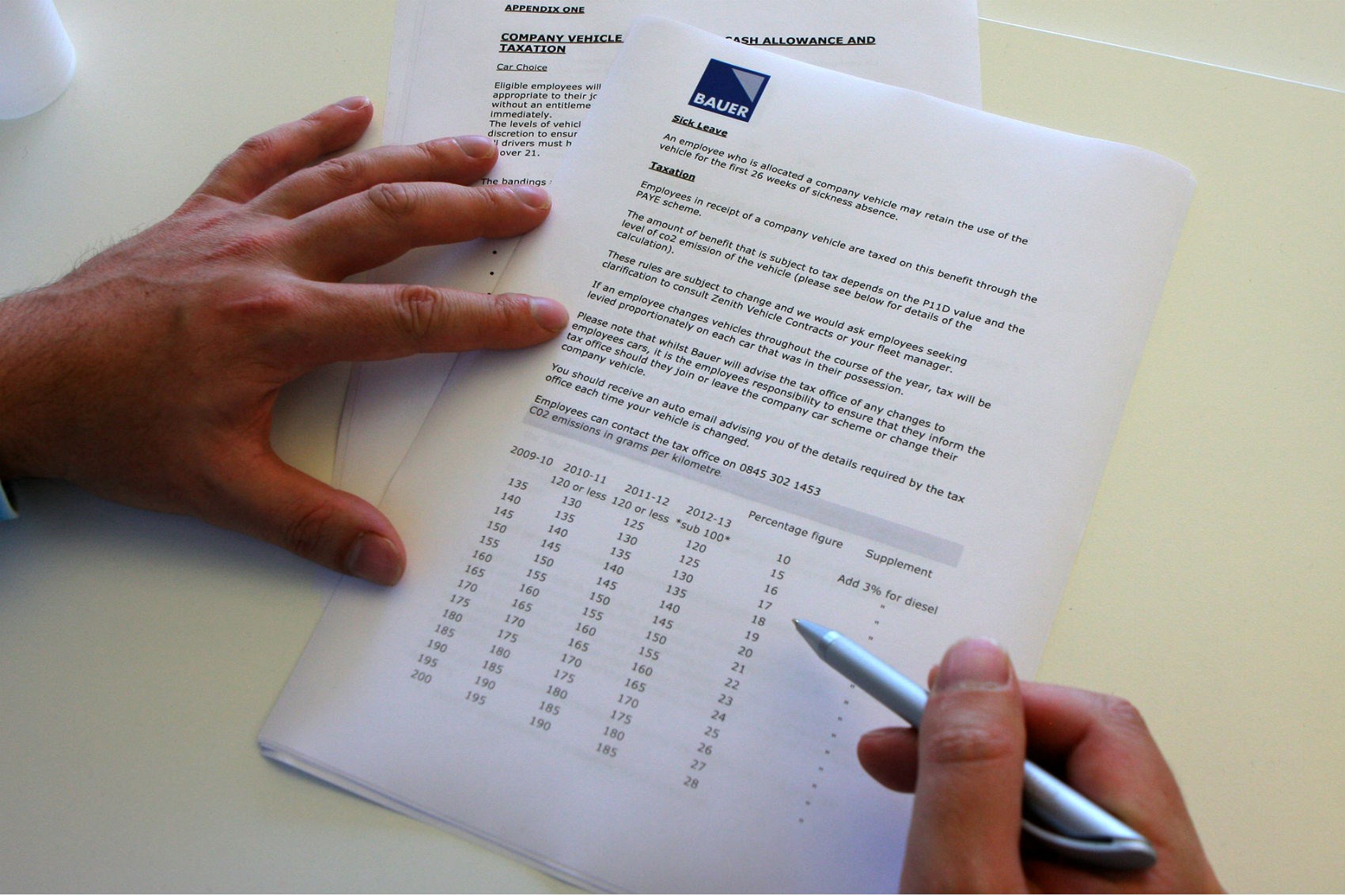

How is a company car taxed? How do you calculate company car tax? Or you can use HMRC’s company car and car fuel benefit calculator if it works in your browser. Using the HMRC calculator.

Calculate the company car tax and any fuel benefit charge on your actual income. Just select your vehicle or enter the P11D value and BIK rate to calculate.

Instantly compare with taking a cash allowance instead. You can also optionally add your capital contribution. Find fully-detailed car specification information, right down to individual models, plus thousands of older versions too. Different rules apply according to the type of fuel used.

Company Car Tax Calculator. Choose the car using the form below. Calculate vehicle tax rates Find out the tax rate for all vehicle types. Car vehicle tax rates are based on either engine size or fuel type and COemissions, depending on when the vehicle was.

You pay tax on the value to you of the company car, which depends on things like how much it would cost to buy and the type of fuel it uses. This includes your list price, P11 BIK (benefit in kind), various benefits and the tax payable at different salary bands. Or if you would prefer a speedier approach, here’s the company car tax calculator provided by our sister website Parkers.

Where tax rates are unknown for future years we have used the latest confirmed rates, rather than attempt a guess at future changes. A company car driver can expect to pay vehicle benefit tax If the company pays for the use of fuel on private journeys, tax on fuel benefit will also be applied.

For a monthly paid car driver on the PAYE system with the correct tax code, one twelfth of the appropriate amount of tax will be deducted from income via the monthly payroll. Benefit in kind tax on company cars is based on carbon dioxide emissions and the list price. Van Tax Calculator.

We have teamed up with Carmen Data Ltd to provide you with some additional van fleet management tools. Terms and Conditions. Understanding UK company car tax.

Multiply that P11D value by the vehicle’s company car tax rate (from a sliding scale depending on the car’s official COoutput, see below) to get your Benefit-in-Kind amount. Our tool also lets you analyse fuel and other associated running costs, as well as comparing the specification of each vehicle. Below is a list of currently available new models. For finding out everything there is to know about company cars.

Some cars run on other fuels - bi-fuel lpg, Efuel and hybrid electric and petrol cars have slightly discounted charges. The tax calculator confirms the cost of Vehicle Excise Duty, for example (road tax ). Furthermore, the history check – that is provided via HPI – confirms whether it is stolen or subject to outstanding finance. The buying tips further facilitate. If you have a choice of company cars then you can compare cars side by side.

The company car tax calculator will help you find the lowest benefit in kind position on the company cars from your choice list. Enter the criteria which matter most to you in choosing your car. Initially select "any" for your secondary criteria, as it is easy to narrow the search later.

Output is limited to the lowest taxed 1cars meeting your search criteria. Motorcycle, tricycle and motorhome rates can be found here. There are a few basics that it’s helpful to understand about car tax.

Your vehicles emission figure will fall into a BIK band which is associated with a percentage. This percentage is applied to the P11D value (list price) of your vehicle, giving you a maximum taxable amount.

Alternative fuel vehicles include hybrids, bioethanol and liquid petroleum gas. Vehicles with a list price of more than £4000. You have to pay an extra £3a year if you have a car or.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.