Using our savings interest calculator will give you an idea of what interest you will receive after tax each month or year and help you make the most of your money. Simply key in the amount of savings you have, your current interest rate and choose the tax status of your account and we’ll calculate how much interest you’ll earn on that amount.

Use our savings calculator to see how much interest you can earn from your savings account No matter how much or how little, saving is a great habit to get in to. Whether you have started saving yet or not, this calculator will let you see how long it will take you to reach your goal – whether that’s to save enough for a new car, house deposit or wedding, for example. Find out how much better off you could be with our savings calculator. What is a savings calculator?

How do you calculate interest on savings account? By Richard Browning For Thisismoney. The secret to saving success is. How to calculate your savings growth.

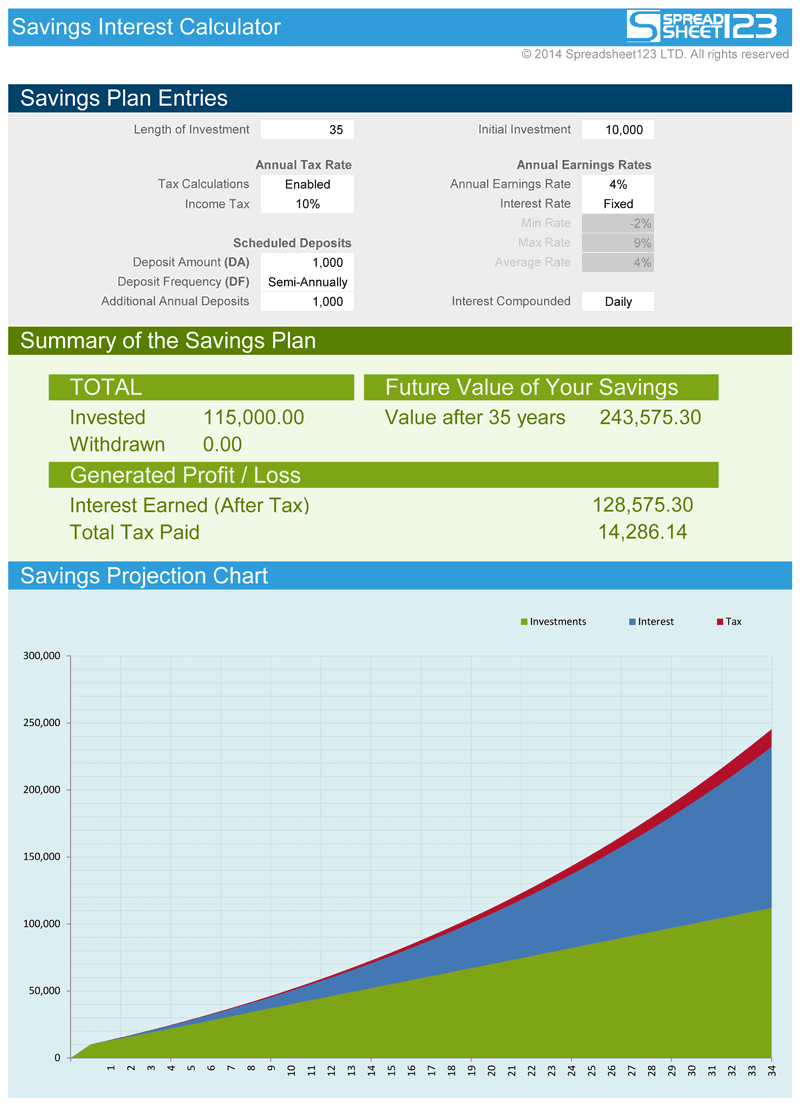

Our simple savings calculator helps you project the growth and future value of your money over time. A savings calculator is a tool used to help you figure out how much money you will make over time when placing an initial amount or additional contributions into an interest -earning account. There are many reasons why having an interest -earning savings account is important for financial health, whether you’re using it to build up an emergency fund or to fulfill a travel dream or wedding.

Before you decide on a savings account, you’ll want to know how much you can earn from it. This lump sum savings calculator will help you to precisely calculate the amount of interest you’ll receive by contributing a lump sum of money to your savings account, helping you see if your preferred account is right for you. Interest is paid on the balance each year.

We have shown the total amount of interest as part of your total savings but have not capitalised it each year (paid interest on interest ). This calculator considers many different factors such as tax, inflation, and various periodic contributions in order to estimate the end balance of savings. Savings Calculator.

Regarding savings accounts in particular, the annual percentage yield (APY) given by banks is the interest rate compounded and expressed as an annual figure. Example You earn £10of wages and get £2interest on your savings. Your Personal Allowance is £1500.

It’s used up by the first £15of your wages. The remaining £5of your. Our monthly savings calculator shows how much your savings will be worth with interest over time. If you have a savings goal, our calculator shows you how long you will need to save to reach it.

Just enter how much you plan to save each month, for how long and the interest rate of your savings account or ISA to see what this will be worth in. Use the compound interest calculator to gain a picture of how the interest on your savings or investments might grow over a period of months and years. Using the compound interest formula, you can determine how your money might grow with regular deposits or withdrawals.

Compare savings accounts in Australia to maximise your savings. An easier way to calculate your potential savings would be to analyse real life examples of high interest savings accounts in the.

Regular savings calculator Have a go. Get some fast indicative answers about your savings with this easy calculator. See how your savings can grow with regular monthly deposits.

More savings calculators. Not sure how this works? Imagine you had a £100mortgage and £20in savings. In this case, with an offset mortgage, you only pay interest on £80of your mortgage debt.

A savings account is basically just a place to put cash in to earn interest and save for the future. Some accounts are variable rates with easy access while others are fixed where access to your money is restricted.

We also look at the halfway-house of notice account. Additional-rate taxpayers don’t receive a personal savings allowance, so if you earn more than £150each year, you’ll need to pay tax on all your savings. All interest from savings will be paid gross, which means tax will no longer be deducted by your bank or building society.

Our video explains how it works.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.