How much interest do you pay back on a loan? It represents the cost of taking out a loan, credit card or mortgage. Find the current balance on your card using the most recent statement. If your card statement does not tell you your.

At the repayment rate you state, you would repay only £10 or £1in interest. So there are presumably some high loan fees that you must repay in addition to the £per. There is no single answer to this. It depends how the lender accrues the interest.

Some banks and building societies add the interest at the start of each year. Then you end up paying off that interest in each monthly payment even though.

Using the above example, multiply £5(the loan amount) by 5. Your credit card may include several different APRs, so it’s important to use the right number as. We compare loans that can be paid back over terms of between one and years.

Representative example: 5. Yet when rates change this can make it more rather than less complicated. Mortgages are the best example. Enter the amount of the loan: £. Payments on the loan will be made: Monthly Bi-Weekly Quarterly Yearly.

/annual-percentage-rate-apr-315533_byexcel_FINAL-4e3f58ac2743412cbcb0b3aadf2107f2.png)

APR amount: 10X 5. The first step is to calculate the dollar amount of each fee and how long it will take to repay it. If you borrow $0you will only get $900. Multiply the loan amount by 0. Create a spreadsheet that calculates the 5% of outstanding balance every month.

If a loan is advertised as being 7. The other 49% could get a different rate (which is usually higher). The following two calculators help reveal the true costs of loans through real APR. What is your monthly interest rate, and how much would you pay or earn on $000? Our calculator uses the Newton-Raphson method to calculate the interest rates on loans.

Loan repayment calculator Work out how much you will pay each month on different-sizes loans with different interest rates by filling in the boxes below theguardian. The interest rate of a loan also describes the yearly cost of borrowing money but it does not include additional lender fees.

This is slightly different from the interest rate because it is made up of the interest rate plus any fees that are automatically included in your loan (for example, any arrangement fees). Given an AER, size of loan, number of monthly payments we can calculate the monthly payments. This is a complex process resulting in a more accurate interest rate figure.

Loan -to-value (LTV) is the ratio of mortgage to property value, expressed as a percentage. Here we have an initial advance of £2and a payment of 3made one month later. This is a sobering example before you decide to use an unauthorised overdraft on your bank account. CFA Example of a Personal Loan.

Working out the Leasing Deal APR. The next step is to work out what the flat rate interest is on your deal. To do this you simply divide the total interest payable by the number of years. In our example: Interest of £520.

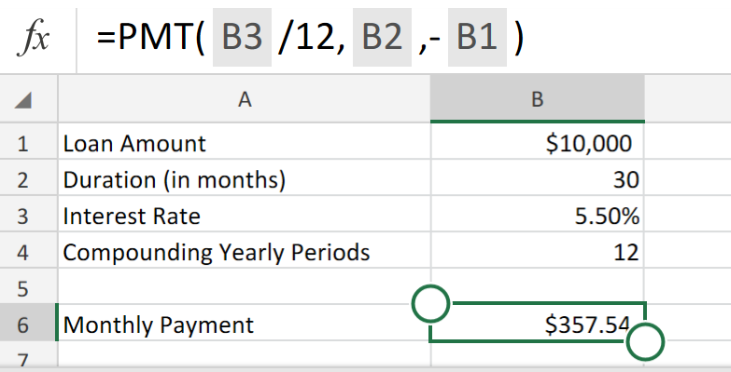

I offer you £10at 8% for years. You need to know the APRs. Amortization Table Consider an initial loan amount of $00 at percent interest per month for months, with equal monthly installment payments of $178. Financials institutions vary in terms of their compounding rate requency - daily, monthly, yearly, etc.

Should you wish to work the interest due on a loan, you can use the loan calculator. With savings accounts, interest can be compounded at either the start or the end of the compounding period (month or year). When is interest compounded?

Use our Loan Calculator to discover the total cost of your loans. See how adjusting your monthly repayment amount impacts your interest payments, the total amount repayable and how long it will take to repay your borrowing in full.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.