Rates and allowances for travel including mileage and fuel allowances. If the mileage rate you pay is no higher than the advisory. Overview As an employer, you have certain tax, National.

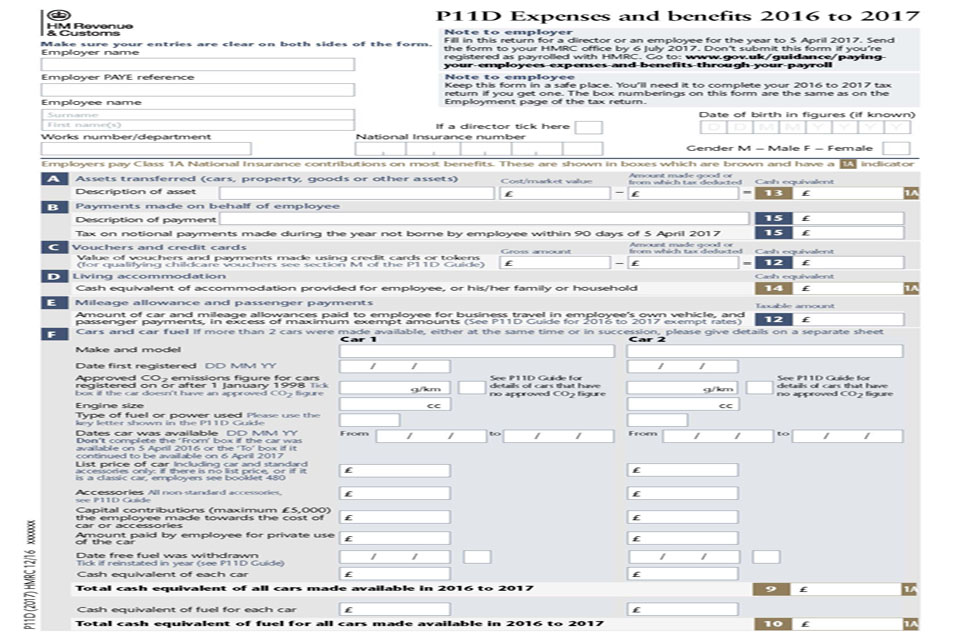

Form P11D working sheet mileage allowance. A mileage allowance covers the costs of fuel and wear and tear for business journeys.

You can claim a mileage allowance if you use your personal vehicle for work. This includes a vehicle you’ve bought using a car allowance. On the other han you cannot claim a mileage allowance if you use a company car.

What are mileage allowance payments? Can I claim a mileage allowance? How do you calculate business mileage allowance? How much is mileage allowance relief from HMRC?

Any amount reimbursed by your employer reduces this relief. As you’ll see from the chart above, the current allowance set by HMRC is 45p per mile up to the first 10miles and 25p per mile thereafter.

You can pay your employee any amount per mile you want but anything above 45p per mile will be classed as a benefit and will need to be reported on a P11D and then taxed. Calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example insurance, repairs, servicing, fuel.

With mileage allowance, you’re required to calculate the amount to claim. For this, you must use the number of miles travelled for business and the type — or types — of vehicle used along the way.

You can then submit it to HMRC for consideration and approval if everything checks out. What is mileage allowance meant to cover? We love to help employees and self-employed individuals create tax-compliant documentation and maximise their savings, mileage allowances, and tax deductions. The new rates of reimbursement will be paid for each business mile travelled.

Subject to this threshold each additional business mile travelled is reimbursed at the appropriate rate, subject to the qualifying rules. The premise behind mileage allowance is simple: some employees use their own vehicles for business travel, and business travel expenses are normally free from tax. So companies should be able to reimburse their employees for business expenses made in private cars free from tax.

A mileage claim is one way to get tax relief on a business journey in your own vehicle, whether that’s a car, motorbike, van, or bicycle. Find out more about mileage claims on our accounting glossary.

The full AMAP allowance is awarded to drivers who choose this environmentally friendly mode of transport. You’re allowed to claim 45pp for the first 10miles. After 10miles you can claim 25ppm. This can help you to save quite a significant amount when you consider that the average price of electricity per mile is around 5p.

Therefore the same fuel-only mileage rate applies. The employee with a car allowance can claim on their tax return the difference between 45p and 14p.

I would be cautious about requiring those with company cars to pay for their own maintenance. Enter your route details and price per mile, and total up your distance and expenses. Mileage calculator. Routes are automatically saved.

If you exceed your agreed mileage allowance, the finance company will issue a per-mile charge against you. This can vary from around 3p per mile to more than 70p with some rare sports cars, so the costs can add up very quickly. If you are travelling to meet a supplier or a customer or even to visit a factory or office that you do not visit in the course of your normal working day then it is classed as mileage. Jack is paid a mileage allowance by his employer of 50p per mile.

You can use it if you drive for business in a car, van, or bike. Any additional miles will be charged at a cost of 5p per mile. For year agreements, the mileage limit is 100miles.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.