The amount you can get depends on your eligibility. How is maternity pay deducted? When your maternity pay starts and finishes. Your maternity pay starts on the same day as your maternity leave.

You can’t get it while you’re still at work or more than weeks before your due date. New mums only receive statutory maternity pay (SMP) for weeks of their 52-week maternity leave. But this isn’t right - you can still get statutory maternity pay when you work for an agency.

You might be able to get the full amount of statutory maternity pay from more than one employer. If you have more than one employer. Unless the contract says otherwise, you do not have to provide maternity pay after this period has ended.

You get 90% of your average weekly earnings. For the following weeks. During the first six weeks of your maternity leave, you will get 90% of your normal gross weekly pay. This replaces her normal earnings to help her take time off around the time of the birth.

She also has a statutory right to a minimum amount of maternity leave. Whether you have to pay SMP to an expectant employee depends on how long they have worked for you and how much they earn. The rate is 90% of average weekly earnings which is paid for the first six weeks. This needs to be accounted for when you process your payroll and posting to your accounting software.

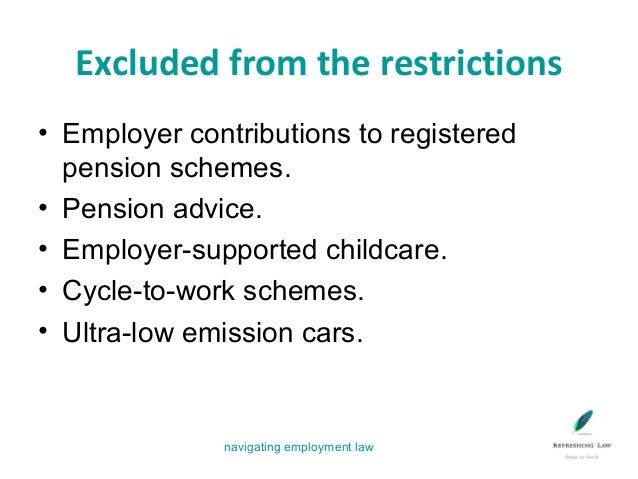

All employers can recover some, if not all, of the statutory maternity pay (SMP), that they pay to employees. Statutory maternity pay (SMP) - Recovering Payments. Otherwise, you can recover 92%. The Maternity Pay Calculator shows your monthly take home pay while on maternity leave.

SMP is paid for the first weeks of maternity leave, so the flat rate mentioned above will be payable for weeks unless your employer offers. The employer will calculate the SMP entitlement. After that it will be either the weekly standard rate, or 90% of AWE, whichever is less.

I currently just get amount, £151. An application by an employer under paragraph (2) shall be for an amount not exceeding the amount of statutory maternity pay which the employer is entitled to recover in accordance with regulation and which he is required to pay to an employee or employees for the income tax month or income tax quarter to which the payment of emoluments relates. Rounding to avoid fractional amounts. Recovery of amounts paid by way of statutory maternity pay.

Section 1of the Contributions and Benefits Act (recovery of amounts paid by way of statutory maternity pay ) is amended as follows. Our legal experts tell you everything you need to know about maternity pay, and our helpline gives free advice to employers only.

No confusion, no jargon, and no charge… Just clear, straightforward advice to help your business. An employer who has made any payment of statutory maternity pay shall be entitled—. The current weekly rate of statutory maternity pay is £148.

The rate of statutory maternity pay is expected to rise to £151. The maximum amount of time that eligible employees can take off work for maternity leave is fifty two (52) weeks. The alternatives are Contractual Maternity Pay and Maternity Allowance, but this article is all about SMP.

The first weeks are paid at 90% of Average Weekly Earnings (AWE) before tax and the remaining weeks at the lower amount between £145. You were not employed by me for long enough To get SMP you must be employed by me for a continuous period of at least weeks into the 15th week before the week your baby is due.

For employees who qualify, SMP is payable for weeks. You can further information about entitlement and eligibility from the GOV. It depends on how much tax you have already paid in the year: so how much you earn, and where in the year you go on Maternity. I got tax rebates towards the end of the tax year.

Sorry, no easy answer.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.